by Stephen Spruce

Founder & CEO

As I talk to those of you managing certification boards around the country, I am regularly impressed with your dedication to your work. It’s clear you’re invested in your board’s mission and the service it provides. And during this past year, it’s likely your dedication has been one of the key reasons you’ve survived the downturn.

Now that we’re returning to a semblance of normalcy, I would like to challenge you to think about your business in a new way. We call it the Business of Certification, with capital letters. The certification industry has used the term before (with no capitals) to mean the legal and regulatory efforts that keep a board in compliance, but I’d like to expand that definition.

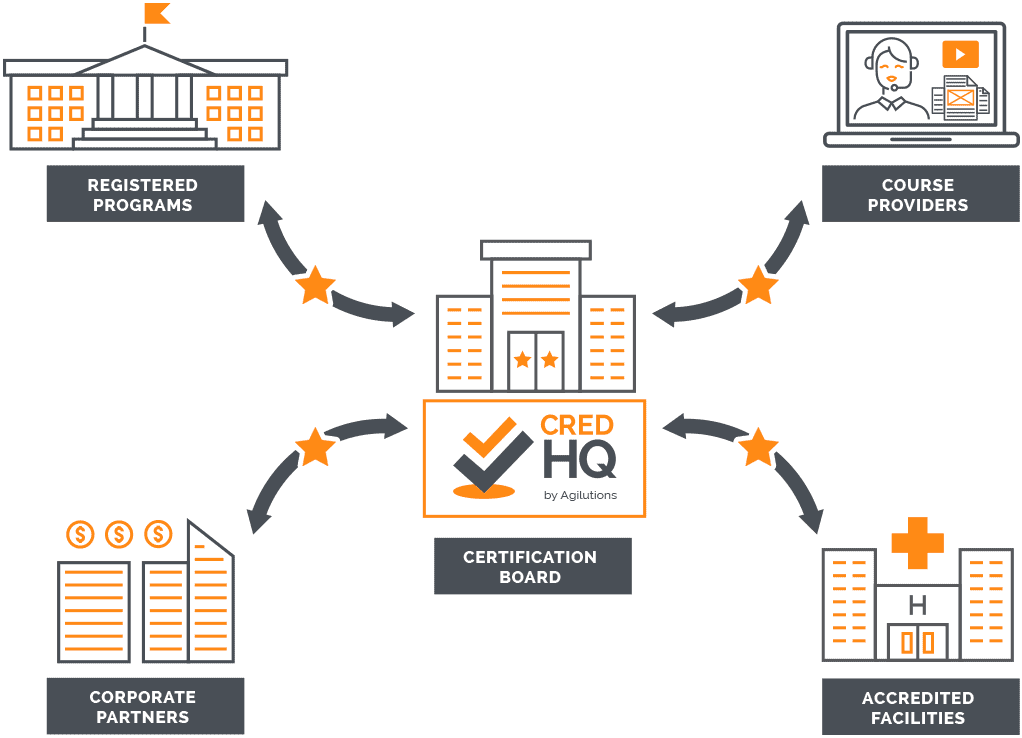

The new Business of Certification encourages boards to create financial stability by diversifying their revenue streams, specifically by developing relationships within their certification ecosystems. We think your board can operate like a for-profit business without sacrificing your not-for-profit tax status, all while fulfilling your mission. Adding revenue streams, while continuing to serve your stakeholders, only increases your financial stability.

Your Corporate Partners Are Also Investors in Your Board

We know your leaders and the industry you serve are invested in the work you do. I think your corporate partners are also invested in your success. I define corporate partners as those firms, hospitals, facilities, and other large employers who need to recruit and retain many certified staff members in order to operate. In a business sense, they are investors in your mission.

Corporate partners need certified staff members for two primary reasons. The first is to ensure a high level of knowledge and expertise throughout the organization. The second is to maximize the organization’s professional image in order to attract new business. A company shopping for a tax accountant, for example, is sure to prefer a firm filled with CPAs instead of a firm of loosely credentialed people. The employees of the second firm may be just as talented, but perception favors the first.

Why Are Corporate Partners Your Best Investors?

Corporate partners are natural investors in your board. They are already in your ecosystem, and you share common goals. You both want certificants to gain and renew their credentials throughout their careers. You both want to ensure that certification keeps professionals current in their fields. By working together, you can positively influence the certification process, as well as help overcome barriers to renewal.

The relationship between the certification board and corporate partners, like other partners in your ecosystem, is a mutually beneficial one…

How Can You Work With Corporate Partners?

The relationship between the certification board and corporate partners, like other partners in your ecosystem, is a mutually beneficial one. You share many of the same goals, and by working together you can simplify the credentialing process for the sponsor’s employees. Here are a few suggestions for how that might happen:

- Create a Candidate Sponsorship Program – Offer your corporate partners a volume discount. For every 25, 50 or 100 seats they buy for your exams, they get a percentage discount. You can sell the seats without knowing specifically who will fill them and issue “coupons” for the sponsor’s employees to redeem. The corporate sponsor will supply names and contact information before the exam, using the “coupons.” The certification board can then provide information about candidate progress so the sponsor can support their candidates and monitor the return on their investment. When the sponsor has used all the purchased seats, you can sell them another package. Many corporations use their certification programs as recruitment tools for new hires by paying for or reducing the cost of the exam.

- Share Candidate Information – Your corporate partners can benefit from the data you collect about the certification status of their employees. You can provide lists of employees in a variety of categories, including those who have attempted the exam, those who have passed, those who need continuing education credits to renew, and those who are ready to renew. Your data can help a partner corporation easily track the status of their employees, identify employees who need additional education credits and prompt employees to work toward renewal. The data will also help them to see and maintain compliance.

- Develop Study Programs – Large corporate partners often hire professionals who have completed their education but haven’t passed the certification exam, with the understanding that earning certification is expected. In a sense, the certification board sets the standards for the “perfect” professional by establishing the domains of knowledge. By sponsoring workshops, practice exams, study groups and providing time to study, the corporate sponsor can help their employees master the domains tested by the exam.

- Identify & Support Certification Candidates – Your corporate partners have regular contact with certificants and can alert you to any gaps in existing continuing education or shifts in the industry that the exam may not cover. With your support, your partners can develop workshops that will address the gaps, including a candidate prep kit that can be delivered and monitored for the sponsor’s future candidates. If you offer practice exams, you could identify any of the partner’s staff members who show aptitude but don’t currently hold certification. You might also offer a screening program to help identify potential candidates.

- Drive Certification Renewals – Once your sponsor’s staff members are certified, you can work with the sponsor to encourage certificants to re-certify when the time comes. Your ability to provide timely data about who needs more continuing education and who is ready to renew will help your partner encourage employees to renew.

What Do Investors Need?

Like most investors, your corporate partners have business needs. Primarily, they need a positive return on investment. Offering a discount for a package of exam seats could meet that need.

Investors also need to monitor their investment. They want to know how well the investment is performing. The board must communicate regularly with the corporate sponsor to assess certificant performance in the industry. Having a conversation with your corporate partners can keep the board staff current with needs in the industry.

Finally, investors need the ability to leverage their investment. Recruiting talented new hires in many industries is highly competitive. Firms that actively support their new staff members with study programs and by paying exam fees are more attractive to new professionals. Working with corporate partners in a program like this can be a valuable benefit for them.

How You Can Afford to Discount Exam Fees

Programs like this are fairly simple in concept, but require a thoughtful approach to pricing and marketing. The certification board has to price the offer so that it’s attractive to corporate partners, but at a level that will ensure that the board’s financial goals are met. It’s a balance between lower fees and increased participation. I believe that once a balance has been established, both the board and the partner will benefit from a new relationship.

By Extending your reach to candidates who might not have taken the exam, you can create new revenue streams…

If you’ve priced the service well, you’ll see an increase in the number of professionals sitting for your exam. With the new revenue you’ll generate, you can pay the administrative costs of corporate partnerships. Be sure your technology is flexible enough to handle the new requirements. By extending your reach to candidates who might not have taken the exam, you can create new revenue streams to help you pay for the technology.

In coming weeks, we’ll talk about other components of the Business of Certification that can give you access to additional new income. We’ll also share stories from our customers.

We’d love to start a conversation with you. If you have questions, visit the CredHQ website or send me an email.